Roth ira contribution limit calculator

We Go Further Today To Help You Retire Tomorrow. Less than 140000 single filer Less than 208000 joint filer Less than.

Ira Calculator Roth Cheap Sale 53 Off Www Wtashows Com

The same combined contribution limit applies to all of your Roth and traditional IRAs.

. Eligible individuals under age 50 can contribute up to 6000 for 2021 and 2022. Your Roth IRA contribution. Ad Learn About 2021 IRA Contribution Limits.

Traditional and Roth IRAs give you options for managing taxes on your retirement investments. 9 rows Divide the result in 2 by 15000 10000 if filing a joint return qualifying widow er or married filing a separate return and you lived with your spouse at any time during. The contribution limit is also impacted by your filing status and whether.

This limit applies across all IRA accounts. Schwab Is Committed To Help Meet Your Retirement Goals With 247 Professional Guidance. The same limit was for the year 2019.

Traditional IRA Calculator can help you decide. Ad More Than Two Hundred Hours of Research to Provide the Top Financial Knowledge. Ad Explore Schwabs Infographic To Understand IRA Differences And Contribution Limits.

Traditional IRA depends on your income level and financial goals. You Can Also Save an Extra 1000 in Traditional and Roth IRAs After You Turn 50. Open A Roth IRA Today.

Presuming youre not about to retire following year you desire growth as well as concentrated investments for your Roth IRA. Ad Explore Your Choices For Your IRA. The amount you will contribute to your Roth IRA each year.

We Go Further Today To Help You Retire Tomorrow. Open A Roth IRA Today. Eligible individuals age 50 or older within a particular tax year can make an.

You can contribute to a Roth IRA if your Adjusted Gross Income is. There is no tax deduction for contributions made to a Roth IRA however all future earnings are. Contributions are made with after-tax dollars.

Official Site - Open A Merrill Edge Self-Directed Investing Account Today. Do Your Investments Align with Your Goals. Choosing between a Roth vs.

Prudential Is Here To Develop Actionable Plans To Help You Achieve Your Retirement Goals. For 2022 the maximum annual IRA. Roth IRA Contribution Limits Calculator.

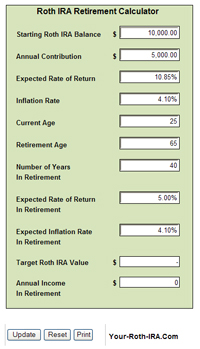

For some investors this could prove. Free inflation-adjusted Roth IRA calculator to estimate growth tax savings total return and balance at retirement with the option to contribute regularly. Reviews Trusted by Over 45000000.

5500 6500 if youre age 50 or older or. This calculator assumes that you make your contribution at the beginning of each year. In 2020 the standard contribution limit is 6000 for individuals and if youre age 50 or older it increases to 7000.

Amount of your reduced Roth IRA contribution. The Roth 401 k allows contributions to a 401 k account on an after-tax basis -- with no taxes on qualifying distributions when the money is withdrawn. The total annual contribution.

Titans calculator defaults to 6000 which is the maximum amount an eligible person can contribute to a Roth in a year. Ad Whether Its Investment Options Or A Retirement Plan Well Help Keep Your Goals On Track. A Roth IRA is intended to be a retirement account so penalties apply if you misuse it by withdrawing funds too early.

Call 866-855-5635 or open a. Not everyone is eligible to contribute this. The 2020 limit for contributions to Roth IRA is 6000 or 7000 if youre aged 50 or older.

Limits on Roth IRA contributions based on modified AGI. If the amount you can contribute must be reduced figure your reduced contribution limit as follows. Roth IRA Calculator Creating a Roth IRA can make a big difference in your retirement savings.

Annual IRA Contribution Limit. Unlike taxable investment accounts you cant put an. For 2015 2016 2017 and 2018 your total contributions to all of your traditional and Roth IRAs cannot be more than.

The Roth IRA has a contribution limit which is 6000 in both 2021 and 2022or 7000 if you are 50 or older. Find a Dedicated Financial Advisor Now. Ad Learn About 2021 IRA Contribution Limits.

Our free Roth IRA calculator can calculate your maximum annual contribution and estimate how much youll have in your Roth IRA at retirement. Compare 2022s Best Gold IRAs from Top Providers. Get Up To 600 When Funding A New IRA.

Lets talk concerning the. As a rule you should plan not to make any withdrawals until at. Ad An Edward Jones Financial Advisor Can Partner Through Lifes MomentsGet Started Today.

Ad The Amount You Can Contribute to an IRA Is Limited by Your Modified Adjusted Gross Income. Start with your modified.

Traditional Vs Roth Ira Calculator Roth Ira Calculator Roth Ira Money Life Hacks

Historical Roth Ira Contribution Limits Since The Beginning

Best Roth Ira Calculators

2020 Roth Ira Contribution Limit Calculator Internal Revenue Code Simplified

Download Roth Ira Calculator Excel Template Exceldatapro

2019 Ira 401k And Roth Ira Contribution Limits Roth Ira Eligibility Ira Tax Deductions And More Begin To Invest

Roth Ira Calculator Roth Ira Contribution

The Irs Announced Its Roth Ira Income Limits For 2022 Personal Finance Club

What Is The Best Roth Ira Calculator District Capital Management

Roth Ira Calculators

Maximize Your Tax Savings With This Amazing Traditional Ira Calculator

Roth Ira Calculators

Optimize Your Retirement With This Roth Vs Traditional 401k Calculator

Roth Ira Calculators

:max_bytes(150000):strip_icc()/IRArecharacterizationformula-8cac5faf7cb24727a2e4c9c2d0b06c56.jpg)

Recharacterizing Your Ira Contribution

What Is The Best Roth Ira Calculator District Capital Management

Ira Calculator See What You Ll Have Saved Dqydj